This week is the annual SXSW Interactive conference, where social media elite descend on Austin to party on Sixth Street, post selfies with people who have higher Klout scores and pick up the mad schwag liberally distributed by startups. A few may even wander into conference halls to see some presentations, although that is far from certain.

This will be my third year staying home, and while I will miss the chats and parties, I will not miss the general sense that SXSW is a missed opportunity for the social media industry. All the best and most experienced minds in the business gather in one spot, but few find themselves in sane, sober and expansive conversations because it is hard to focus on serious topics when one is screaming over an indie band or dashing from the Convention Center to South Commerce to West 6th for events.

Although SXSW Interactive has tended to feature more hype than criticism, perhaps 2015 will be the year when reality sets in. At last fall’s Social Shake-Up, I was pleasantly surprised at the candor at which people were discussing declining reach, difficult social metrics and social media marketing obstacles. It will be interesting to see whether the predominant buzz from this year’s SXSW is about social media marketing difficulties or the more typical chatter about the next hot new app.

If SXSW Interactive gets serious about substance over hype, here are seven recent studies that should be mentioned from stages in Austin. All challenge assumptions about the value of social media marketing and offer the sorts of data that should guide tough decisions about investments and strategies in the social channel this year:

- Bounce Exchange find poor organic social acquisition and conversion: In 2014, Bounce Exchange analyzed more than $1 billion of e-commerce revenue. Their research found that organic traffic from these companies’ social media channels accounted for only 1.2% of clients’ overall revenue. Moreover, conversion was 1.3%, less than half of their clients’ overall average. (Source)

- The Center for Marketing Research at the University of Massachusetts Dartmouth finds fewer companies optimistic about tracking sales through social media: In interviews with executives at Inc. 500 firms, the UMASS study found a drop in companies tracking sales through social media, from 36% in 2013 to 32% in 2014. Even more telling, at a time when marketers are spending more on social media and should be improving their metrics, the number of executives who do not know if social is driving sales increased seven points, from 11% to 18% (and another 44% believe it accounts for less than one percent of sales).

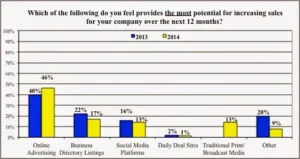

Finally, the UMASS study found that Inc. 500 executives are losing faith that social has the potential to increase sales in the next year–the percentage of executives who indicate social is the tactic with the most potential to drive sales dropped from 16% in 2013 to 13% in 2014. That puts social media well below online advertising, less than business directory listings and equal to traditional print/broadcast media. (Source)

- Custora finds social drives small fraction of sales compared to organic search, PPC and email: Custora tracked 100 million anonymized shoppers, $40B in e-commerce revenue, and 100+ online retailers in January 2015. It found that social media delivers just 2% of ecommerce sales. This figure is 91% less than organic search, 88% less than CPC and 87% less than email. Custora’s data was no different over the holiday period. In its E-Commerce Pulse 2014 Recap, the company notes, “Similar to the trends last holiday season, and throughout 2014, social media (including Facebook, Twitter, Instagram, and Pinterest) is still not driving a substantial share of e-commerce transactions. Through the holiday season (November – December 2014), social media drove only 1.9% of all e-commerce orders – a similar share to holiday 2013, when it drove 2.3%.” (Source and source)

- Webmarketing123 finds that, when it comes to social media investment decisions, marketers are using assumptions rather than hard metrics: A November 2014 study by Webmarketing123 found that that “many marketers still relied on ‘gut instinct’ when determining which channels to use for marketing campaigns, as the most-used weren’t always the most-measured.” The report called social media “one of the biggest pain points for respondents.” While 87% of B2B marketers used social media, just 17% were able to prove its ROI—that is the lowest percentage among channels used. As for B2C marketers, social is now the most commonly used channel, with 87% of B2Cs using social, but only 27% could calculate ROI. (Source)

- MaritzCX finds that social media is not an influential information source for car buyers: MartizCX surveyed 60,000 people and found that social networks (Facebook, Google+ and Linked) were the 19th most influential information source when customers under the age of 35 research a new vehicle. While “Family/friend/word of mouth” ranked second at 18.8%, online social channels were much less significant, with “Chat rooms/blogs/forums” at 1.5%, online videos at 1.3%, social networks at 0.4% and Twitter (dead last) at 0.2%. Beating digital social channels at influencing car purchases are very traditional channels such as salespeople at dealerships (the top influencer at 21.5%), newspaper/magazine reviews (4.7%), TV ads (3.6%) and manufacturer’s brochures (2.8%). (Source)

- The CMO Survey finds that marketers continue to use the least powerful social media metrics: It is amazing that the two most common social media metrics used by marketers this far into the social era are still Hits/Visits/Page Views and Number of Followers or Friends. We are well past thinking that top-of-the funnel metrics are a good way to measure any digital marketing tactic, much less social media. Less than a third of marketers evaluate social media based on conversion rates, and fewer than one in seven use customer acquisition cost.

Even more concerning, there has been a decrease since 2010 in the number of marketers using bottom-of-funnel social media metrics such as Sales Levels, Revenue per Customer and Profits per Customer. Marketers are ignoring the most powerful metrics in order to focus on the ones that are easiest to collect (and to manipulate). (Source)

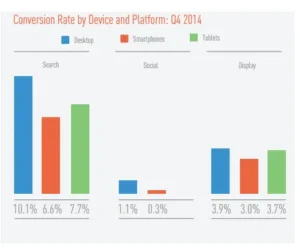

- Marin Software finds social advertising significantly lags search and display: The Marin Software Performance Marketer’s Benchmark Report is expansive, covering over $6 billion worth of ad spend from advertisers and agencies with budgets in excess of $1 million annually on paid-search, display, social, and mobile. First the good news for social media: The clickthrough rate for social ads is better than for display ads–social CTR was double that of banners on desktop and 50% greater on smartphones. However, while social ad clickthrough may beat display, it still pales in comparison to search, which has a 425% better CTR on desktop and 383% greater on smartphones.

Once the folks who click on those ads arrive on your site, social conversion rates are downright dismal. Compared to social ads, display advertising’s conversion rates are 255% greater on mobile and 900% more on smartphones. Social advertising conversions fare even worse against search ads; search ads deliver conversion rates 818% higher on desktops and 2100% greater on smartphones versus social ads.

While social advertising offers the lowest cost per click (CPC), advertisers (at least those whose goal is conversion) are over-paying for social ads. Desktop social ads offer a CPC 82% less than desktop search ads but return a conversion rate 89% less than desktop search, making social advertising’s cost per conversion around 65% greater on desktop. On mobile, social advertising has a cost per click that is 80% less than search ads but experience conversion rates 95% less than search, resulting in a cost per conversion that is more than four times greater in social than search. (source)

Will data like this get attention, discussion and consideration at SXSW, or will this year’s conference continue its history of celebrating consumer adoption and the rare but unrepeatable successful case study? If SXSW attendees buzz about the growth of “dark social” and Audi’s Super Bowl Snapchat success rather than explore what we have learned from our experience on the social networks that have been around for eight years, then we will simply see brands repeat the same mistakes on Snapchat, LINE and WhatsApp that they made on Facebook and Twitter.

For those attending SXSW Interactive, my wish is that you have more challenging, sober and enlightening discussions than you do drinks and that you leave Austin with more hard data than promo items.